Analysis of Owning vs Renting a Home in the UK: A Financial Comparison Over 25 Years

Financial Implications of Buying vs Renting a Home in the UK Over 25 Years

Deciding whether to buy or rent a home remains a challenging decision for many individuals in the UK. To provide a comprehensive analysis of the financial implications, we will delve into the historical context and initial costs associated with owning versus renting a home.

Historical Context and Initial Costs

In 1999, the average property value in the UK stood at £81,628, with a typical monthly rent of £450 and an interest rate of 6%. Fast forward to today, the monthly rent for the same property would be around £1,200, resulting in a total expenditure of £172,964 over 25 years with no financial return for renters.

For home buyers, the initial monthly mortgage payment in 1999 at a 6% interest rate would have been £408. With a weighted average interest rate of 4.29% over 25 years, the average monthly payment amounts to £444, totaling £133,212. Additionally, repairs costing 1% of the property value annually amount to £20,407 over the same period.

Financial Outcomes of Buying vs Renting

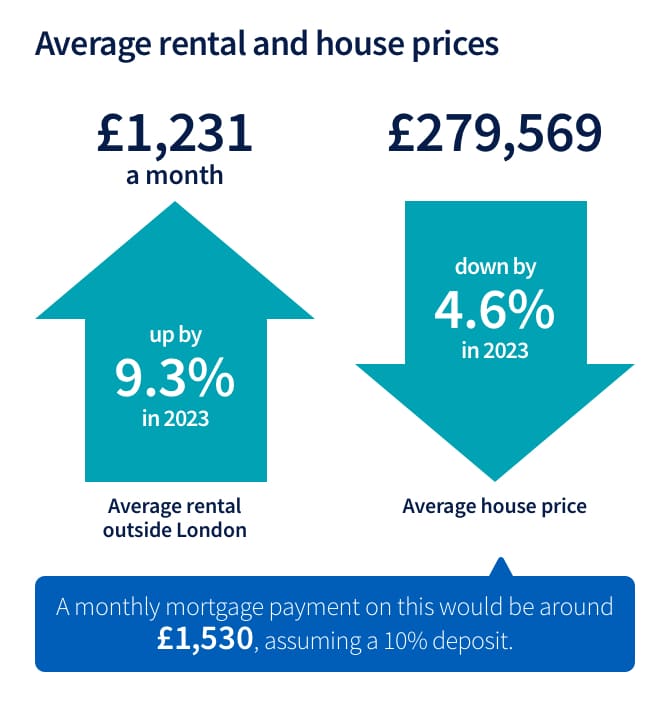

When comparing the total cost of owning a home, including mortgage payments and repairs (£153,619), to the cumulative rent expenditure (£172,964), owning a home results in a saving of £19,345 over 25 years. Furthermore, the increase in property value from £81,628 to £285,000 today translates into a gain of £203,372 for buyers, resulting in a net benefit of £222,717.

Assuming the average buyer purchases a home at 32, pays off the mortgage at 57, and lives mortgage-free until the age of 81, the accumulated financial advantage of buying a home over renting amounts to £479,997. Taking strategic market cycles into consideration is essential to maximize these financial gains and avoid buying during periods of market euphoria.

In conclusion, the data illustrates how buying a home in the UK can lead to significant financial benefits compared to renting, making it a more profitable long-term investment option.